Provides financial protection against potential liabilities, such as injuries, infections, or property damage, arising from the tattooing process or other related activities within the parlour.

Tattoo parlours need insurance to protect against risks like injuries from tattooing and property damage from events like fires or thefts, ensuring they can cover medical costs and legal claims while keeping their business running smoothly.

These insurance types protect tattoo parlours from common industry risks, ensuring they can operate securely and continue offering services with financial peace of mind.

Covers claims arising from alleged negligence, errors, or harm caused by services, such as a client alleging improper sterilisation or allergic reactions due to ink or procedures.

Essential for covering claims related to third-party injuries or property damage that may occur on the premises, such as a client tripping and injuring themselves.

Necessary if the parlour stores client information electronically, covering costs associated with data breaches or cyberattacks, especially if booking or payment systems are digital.

Covers moveable items and supplies within the parlour, including inks, sterilisation equipment, and furniture, from risks like accidental damage or theft.

Protects the building and its fixtures, including chairs, tattoo machines, and other equipment, against damage from risks like fire, theft, or vandalism.

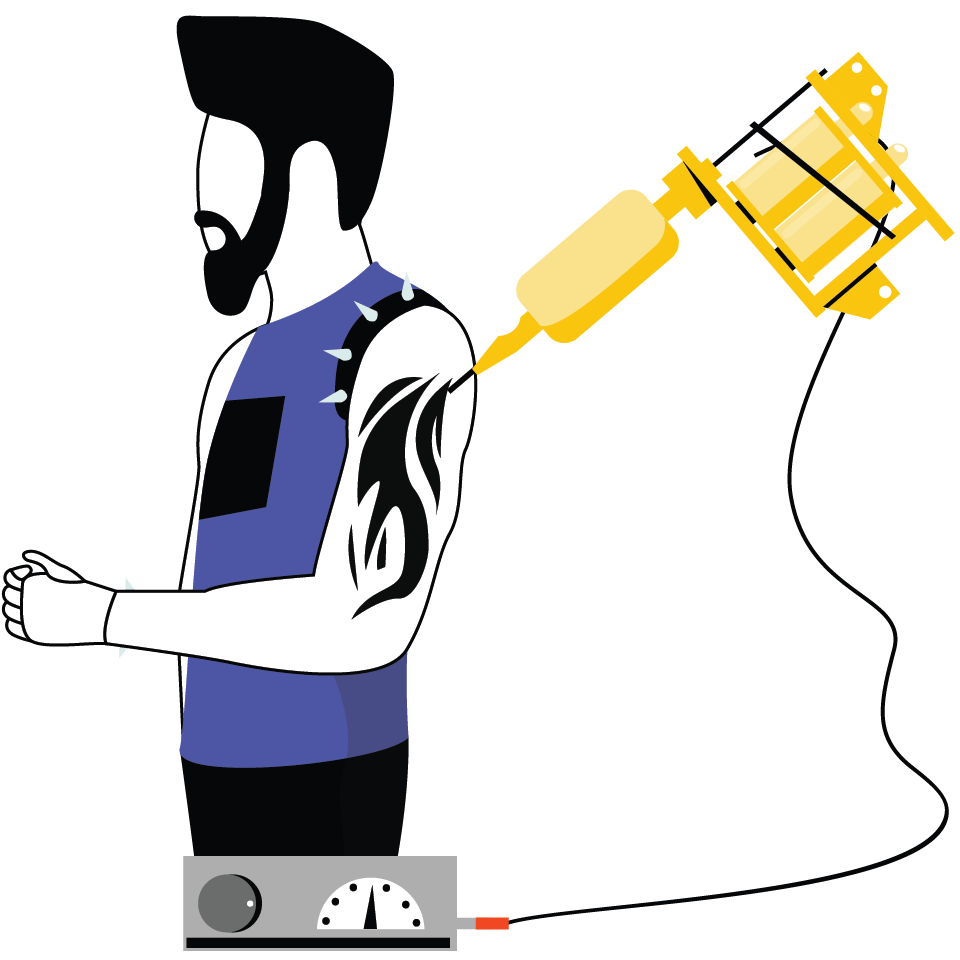

Important for tattoo parlours, this insurance covers claims of injury or harm from products used on clients, such as inks, needles, or aftercare products.

Required if the parlour employs staff, covering medical expenses and lost wages for employees injured while working, such as strains or exposure to chemicals.

A client experiences a severe allergic reaction to the tattoo ink used during a session at your parlour. They require medical treatment, and subsequently, they decide to sue your business for the medical expenses and pain and suffering they endured. Tattoo parlours need public liability insurance to cover the costs of legal defense and potential settlements or judgments in cases like this.

A fire breaks out in your tattoo parlour due to an electrical fault, destroying your equipment, artwork, and furnishings. Business property insurance is essential in this scenario, as it can cover the cost of repairing or replacing the damaged property and help your business recover from the financial impact of the fire.

One of your tattoo artists accidentally slips and falls while working in the studio, sustaining a serious injury. Workers’ compensation insurance is necessary to cover their medical expenses and provide them with wage replacement benefits during their recovery. Without this coverage, your business could be held responsible for these costs, which may lead to financial strain.

We will match the ideal insurance partner to you.