Tailored insurance solutions designed to protect Metal Processes & Engineering businesses, ensuring comprehensive coverage for assets, equipment, and operations against unforeseen risks.

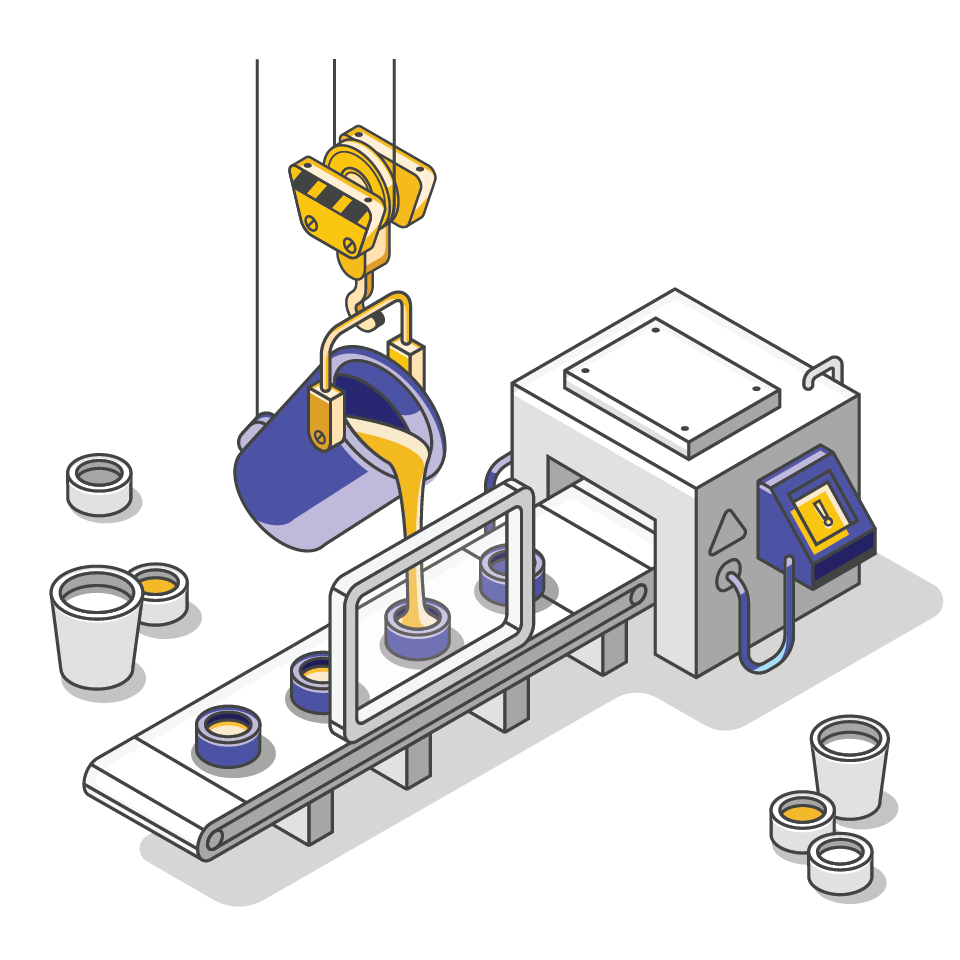

Metal processing and engineering businesses need insurance to mitigate operational risks, including machinery damage and workplace accidents. Insurance provides crucial financial protection, covering property damage, liability claims, and disruptions, ensuring continuity and long-term success by safeguarding assets and enabling efficient recovery from unexpected events.

These insurance types help metal processing and engineering businesses safeguard their operations, protect valuable assets, and ensure financial stability in the face of unexpected challenges.

Covers vehicles used for transporting raw materials or finished products, protecting against accidents, theft, or damage.

Protects against claims of third-party injuries or property damage caused during business operations, such as accidents involving clients or visitors on-site.

Protects against losses from cyber-attacks, data breaches, or system hacks, particularly for businesses relying on digital technologies for operations or customer interactions.

Offers financial support to cover lost income and ongoing expenses if operations are disrupted due to a covered event, like a fire or flood.

Provides coverage for the physical premises, machinery, tools, and inventory against risks such as fire, theft, vandalism, or natural disasters.

Covers claims arising from defects in manufactured metal products that may cause harm or property damage to end users or customers.

Required for businesses with employees, covering medical expenses, lost wages, and rehabilitation costs for workers injured while on the job.

Addresses liabilities arising from environmental pollution caused during metal processing activities, such as chemical spills or emissions.

Imagine a critical piece of machinery in a metal processing plant experiencing a sudden breakdown, causing production delays. Equipment Breakdown Insurance would help cover the cost of repairing or replacing the equipment and Business Interruption Insurance would provide coverage for the income lost during the downtime, ensuring the business can recover and resume operations without significant financial strain.

Suppose a metal engineering business manufactures a component used in various products. If a defect in the component leads to property damage or injuries, the business could face a product liability lawsuit. Product Liability Insurance would help cover legal expenses, settlements, or judgments, shielding the business from the financial repercussions of such a claim and preserving its reputation in the market.

In the metal processing and engineering industry, where employees often work with heavy machinery and specialised equipment, the risk of workplace injuries is a concern. If an employee is injured on the job, Workers’ Compensation Insurance would cover medical expenses and lost wages, protecting both the employee and the business from the financial implications of the injury.

We will match the ideal insurance partner to you.