A financial protection policy that covers potential liabilities and risks associated with professional skincare and beauty services.

Estheticians and beauty salons need business insurance to protect themselves financially from accidents, injuries, or lawsuits that could happen during their work. It helps cover costs like legal fees and medical expenses, ensuring they can stay in business and maintain their reputation even if something goes wrong.

The specific insurance needs of an Esthetician or Beauty Salon may vary depending on factors like the type of services offered, the location of the business, and the number of employees.

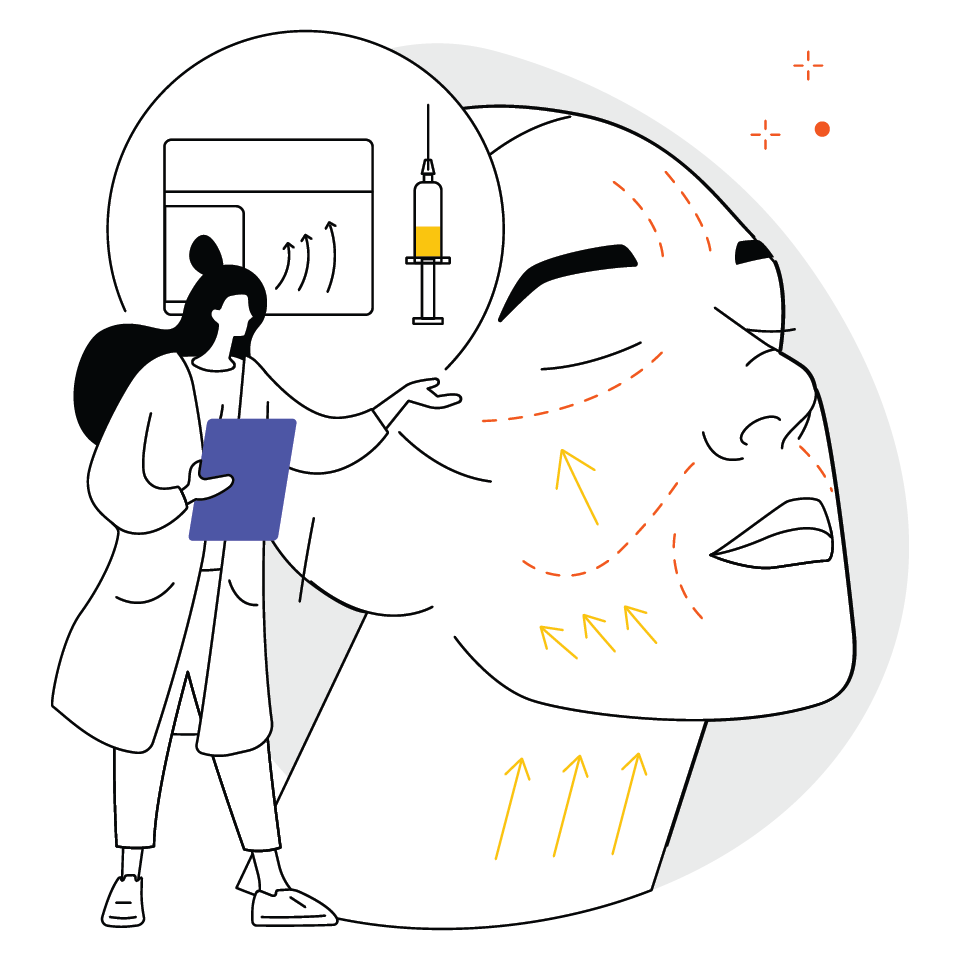

Recommended types of insurance coverage for Estheticians typically include:

Essential for beauty therapists and estheticians, this covers claims of negligence, errors, or omissions in the services provided, such as a client experiencing an adverse reaction to a treatment or product.

Protects against claims for third-party injuries or property damage that may occur on the premises, such as a client slipping in the salon or being injured during a treatment.

Important if the salon stores client information digitally or handles online bookings, this covers the costs associated with data breaches, hacking, and cyberattacks.

Provides coverage for lost income and ongoing expenses if the salon’s operations are disrupted due to unforeseen events, like fire, flooding, or equipment failure that forces the business to close temporarily.

Covers damage or loss of the salon’s physical assets, including furniture, treatment tools, and equipment, from risks like fire, theft, or vandalism.

Protects against claims related to products sold or used during treatments, such as skin reactions or injuries caused by defective beauty products.

Required if the salon employs staff, this covers medical expenses and lost wages for work-related injuries or illnesses, such as repetitive strain injuries or chemical burns.

Imagine an esthetician performs a facial treatment on a client using a new skincare product. Unfortunately, the client experiences a severe allergic reaction, resulting in skin irritation and medical expenses. In this case, the esthetician would need professional indemnity insurance to cover the costs of potential legal claims and compensation for the client’s injuries.

An esthetician’s equipment, such as high-end skincare devices or specialised tools, is stolen from their salon or studio. Business property insurance would help replace the stolen equipment, ensuring that the esthetician can continue to provide services without a significant financial setback

While providing a spa service, a client slips and falls in the esthetician’s treatment room, sustaining injuries. Public liability insurance would come into play to cover the client’s medical expenses, any potential legal claims, and the cost of defending against such claims.

We will match the ideal insurance partner to you.